Today is a monumental one for you and your family. Seriously. It’s the day you learn your “financial reality number” and why it’s so important. Your financial reality number, or net worth, is the true measure of your financial wellness.

Your financial reality number gives you the overall big picture of your money. It allows you to accurately understand your current financial situation. It also tells you if you’re moving closer to or further away from your biggest financial dreams. Unfortunately, your day-to-day financial transactions do not give you an accurate view of your money unless you take into account your financial reality number along with it.

So what is a financial reality number, and how do you determine yours? As mentioned in the title of this article, and above, the financial reality number is what you hear others refer to as net worth. It’s time to discover your net worth!

/>

/>

First, why am I referring to it as a “financial reality number” and not “net worth”?

You may have groaned when you heard the term “net worth.” Or you may have wondered, “what exactly is that?” I really dislike the term net worth. See, I feel the term implies your worth as a person is based primarily on your financial situation and solely on the numbers. And that’s totally unfair.

See, if our net worth truly represents our worth as a person and even our whole financial picture, it doesn’t take into account the things we do that may decrease our net worth, yet increase our generosity.

One of my favorite reasons to steward money well, especially as a Christian, is to be able to give generously! When we give money away to people and causes we love, our net worth may decrease, but it is such a blessing to be able to do so!

To prevent this from turning into a rant about the term “net worth”, I will leave it at that one example. Just know this: your worthiness, my friend, does not come from your financials. It comes from who you are as a person, and most importantly, as a child of God!

Though your net worth does not represent your worth as a human being, it is actually a very important number!

Always keep in mind your true worth certainly does NOT come from your financial numbers. But your financial reality number is very beneficial to use as a reference point in order to steward your money wisely and intentionally! It’s a great way to measure your progress in reaching your financial dreams! It can also be very motivating to move you forward in those dreams!

Now, for the purposes of this article, I will continue using the term “net worth” simply because I need Google to know what I’m actually talking about. 😉 Every time I say it, though, just change it in your head to “financial reality number.”

/>

/>

How do you figure out your net worth (or financial reality number)?

It’s actually pretty simple. You just have to know the dollar amount of the things you own (assets) and the amount you have left to pay on things you owe (liabilities, or debts).

What are your assets?

Your assets include your home, vehicle(s), any cash savings or accounts you have, retirement savings, investments (bonds, stocks, etc. ), and anything else you have that is worth something monetarily speaking. You could include smaller, less expensive items you own, like your furniture, jewelry, etc, but I don’t usually get that detailed.

How much are those assets worth?

After listing your assets, go back and assign a dollar value to each.

Let’s use Leigh’s assets as an example. She’s 28 years old.

She owns a small home, worth $80,000. Her vehicle is worth $10,000, she has $7000 in a 401(k) employee retirement plan through her workplace, and $3000 in an emergency savings account.

Leigh’s total assets add up to $100,000.

Now let’s move on to the next part of your financial reality number.

What are your liabilities, or debt?

Your liabilities (or debts) include the mortgage on your home, car loan(s), student loan(s), credit card balance(s), and anything else you owe money on.

Determine the dollar amount remaining to pay off everything you owe.

Again, let’s use Leigh’s debts as an example.

She has $75,000 left to pay on her mortgage. Unfortunately, she’s a little upside down on her car and still owes $11,000. She has a student loan with $15,000 remaining, and a credit card with a $3000 balance.

Leigh owes a total of $104,000 on her debts.

Before we dive into Leigh’s financial reality number, let’s discuss something that’s super important to understand about your net worth.

What does net worth actually tell you about your money that looking at your day-to-day finances doesn’t?

Most people tend to gauge their financial wellness on whether or not they make enough money to pay their bills and live comfortably on what’s left. It’s how we get into the trap of making monthly payments on larger purchases, and how credit cards allow us to buy way more than we can actually afford.

We base our financial decisions on if we can afford the payments (especially the minimum payments on credit cards), and if our income can support the payments each month. Many times, those payments can leave us stressed out financially, and even get us in major financial trouble down the road.

Here’s the reason I love using the financial reality number as a benchmark instead of just looking at income and expenses —> The financial reality number is an indicator over time that takes into account every aspect of our money.

If we check our financial reality number, instead of our bank account, before we make a money decision, and use it as a guide, we will make a smarter decision. It allows us to reach our financial dreams faster, with less debt, less guilt, less stress, and way more intention!

How do you calculate your net worth, or financial reality number?

Now it’s time to determine that number.

The formula to calculate your financial reality number is Assets – Liabilities = Net Worth (aka financial reality number)

Here’s the calculation for Leigh:

$100,000 – $104,000 = -$4,000 (negative $4000)

Leigh has a negative financial reality number, which is actually extremely common for American families. Most are much more negative than Leigh’s. If your number falls into the negative category, please don’t feel guilt or shame or get depressed. Remember, this is so very common, and the fact you are reading this now and facing it is absolutely huge! Congrats to you, friend!

You can calculate your own financial reality number by hand or use NerdWallet’s simple net worth calculator.

Also, keep reading to find out my favorite app/website for tracking net worth regularly with very little effort!

Once you know your net worth, or financial reality number, then what?

Now that Leigh knows her financial reality number, she can begin to make positive change with her money and do things that will increase that number over time.

Leigh now can see that as she’s paying down her student loans and mortgage, her net worth will increase. $4000 paid toward the principles, and she will get her financial reality number to an even zero, which would be a wonderful accomplishment!!!

As she watches this number over time, she will also realize that having a credit card balance and only paying the minimum each month is actually making her net worth more negative. She’s having to pay back a ton more than she originally paid for her purchases too! This encourages her to pay extra on the credit card as fast as possible to pay it off. She plans to no longer use her credit card and keep her savings account beefed up in case of emergency. (Increasing her savings account increases her net worth, as well!)

How often should I look at my net worth?

Leigh has figured out it’s a good idea for a “reality check” with her net worth every month, and especially if trying to decide on a major financial decision, such as a vehicle purchase. Before purchasing, she can do a quick calculation to see how it will affect her financial reality number.

By the way, there’s an amazing website/app to keep up with your financial reality number without having to manually calculate your numbers each month! And…if you are fortunate enough to have a 401(k) or other qualifying investment account, you can get a $50 Amazon gift card! Just email me at pennystewardmama@gmail.com for my referral code before you sign up!

The app/website is called Personal Capital, and I’d highly recommend letting it do all your number crunching! All you have to do is link your accounts in their platform, then sit back and keep an eye on your financial reality number! You will be amazed at how convenient it is! (And a $50 Amazon gift card doesn’t sound too bad either, does it?)

Congrats on making today monumental for you (and even your family!)

You now know what the term “net worth” means and that in actuality, it’s your financial reality number! Begin to use it as a marker to figure out what to do next with your finances, and you will make smarter decisions that affect your finances in the positive direction!

Keep an eye on this number over time (use Personal Capital to make that super easy!), and you’ll start to see how much your efforts with your money pay off. It will help you stay motivated and reach your financial dreams!

As always, steward your money — and your life — intentionally.

Heather

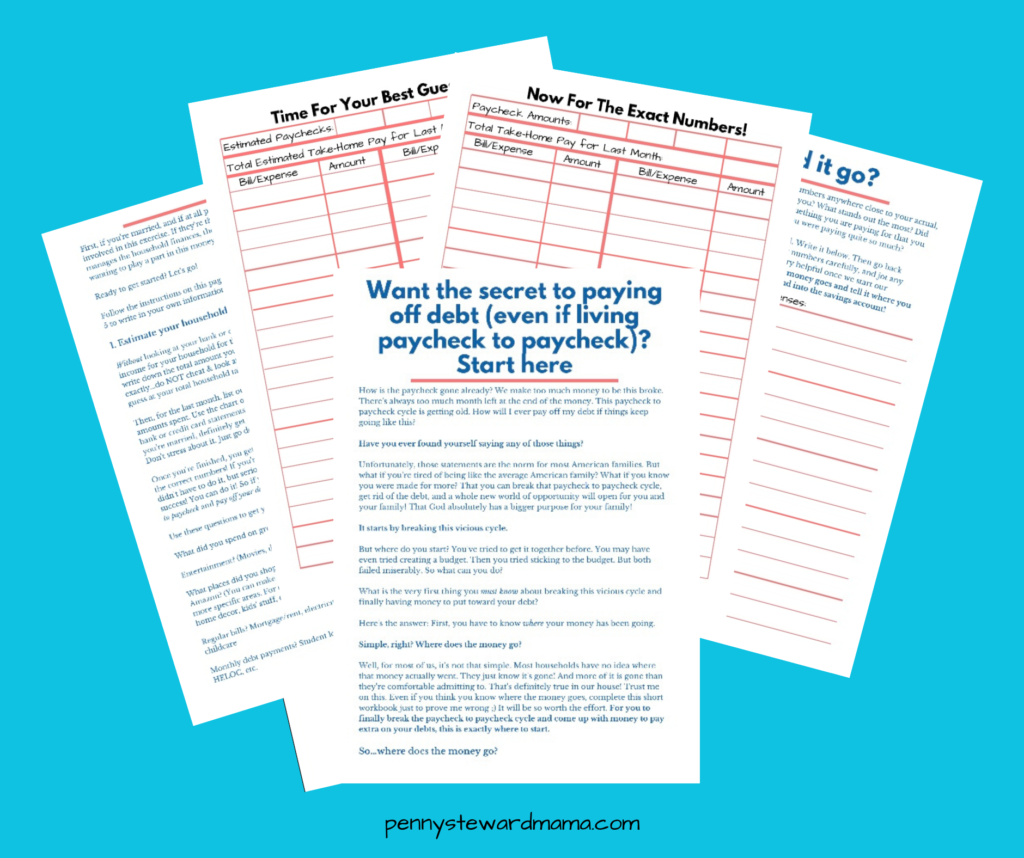

P.S. Want the secret to paying off debt or saving more (even if living paycheck to paycheck)? It’s a free bonus offered in my private Facebook group Money Savvy Moms Living for Him! Come join our little community and get the free bonus!