Saving for a vacation? What about Christmas? Is December getting close and you know that (yet again) it will be super stressful regarding the finances? Or when your car insurance premiums come due and oops, you had to scramble to come up with that six-month premium? There is a solution for paying cash in these types of scenarios, and it’s NOT to dip into your emergency fund or put it on a credit card! That solution for saving for big purchases or bills is to create some sinking funds!

What exactly is a sinking fund?

Getting down to the basics, a sinking fund is money you set aside for an intended purpose. You “sink” money into the fund so that once a large bill comes due (like a 6- or 12-month car insurance premium) or a major purchase is needed (like around Christmas-time), the money is already there, ready to spend! How amazing does that sound!

You don’t have to figure out financing or put it on a credit card and pay for that purchase for months — or even years — to come! You have the money in YOUR bank account, stress-free!

What are some examples of sinking funds?

There are the more obvious sinking funds like I shared above: Christmas and car insurance premiums. Others include life insurance premiums due once or twice a year, vacation savings, home improvements/decor, larger furniture purchases, and even a new (or new-to-you) vehicle to be paid for in cash!!

When was the last time you replaced the tires on your vehicle? Do you remember the cost? Yeah…they can be super expensive! What if you had that money in a savings account, ready to transfer to your checking account, and pay with your debit card? How would that make you feel?

What about unexpected expenses, like a car or home repair?

You can also plan for the unexpected expenses that will pop up from time to time, like car repairs, home repairs, and health expenses. You may not know the exact amount you’ll need, but you can put aside some money each month specifically for the “expected unexpected” things. Then you may be able to avoid using your emergency fund for these things.

***Make sure you grab the budget category printables, which also includes sinking fund categories and a worksheet to keep your sinking funds organized!***

What about monthly bills that fluctuate?

Now, are you ready for a novel idea? Instead of treating your utilities (such as gas and electric) like a monthly bill that can go up or down, create a sinking fund for them! Just add up your monthly bills for the past year, divide by 12, then save that amount each month (plus a little extra for yearly increased costs.) You’ll be ready the next time it’s much higher than you expected!

What is the best way to keep track of a sinking fund?

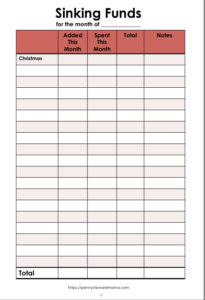

Keeping up with a list or a spreadsheet will make it clear where this money should go. I update mine at the end of each month, when I finalize my monthly budget.

By the way, the Penny Steward Mama community does a monthly Budget Challenge, which allows us to finish up our last month’s budget and begin the next one. If you’re a beginner budgeter, it will walk you through creating your own budget for the very first time! Read more about the budget challenge or sign up for next month’s budget challenge AND you’ll go ahead and get the free budgeting printables along with the SINKING FUND TRACKER!!

Where is the best place to hold the money for my sinking fund(s) that I intend to use for a major purchase or expense?

Most people find a separate savings account helpful to “store” their sinking fund money. Just set it up for an auto transfer every month (or pay period)! Then when the time comes for you to use the money, just transfer the amount needed back into your checking account.

You can decide if having one account to lump all sinking funds together works for you or if you need a separate saving account for each sinking fund.

How do you decide how much money to save in a certain sinking fund each month?

Take the expense that you know is coming and divide by the number of months you have left to save for it.

For example: your child’s birthday is coming up 5 months from now. You know you would like to spend about $300 for his party. $300 divided by 5 is $60. Also, say your $600 car insurance bill is due in 3 months. That’s $200 a month. So go ahead and plan now and auto-transfer that $260 each month. ($60 for the birthday party fund and $200 for the car insurance fund.)

$260 may be a lot to come up with this month, but it’s much better than a $600 bill in one month and a $300 bill in another! Plus, once you get “caught up” with sinking funds, you can divide the entire purchase by 12 months and start saving for the next year! Then your monthly savings amount becomes much smaller!!

Frugal tip to consider: Begin shopping for cheaper car insurance AND find some creative ways to cut down the party expense 😉

Woohoo!! Time to get started saving money in your sinking funds!!

You get the idea by now. Think how much stress will be relieved if you have your “sinking fund” saving account set up and funded!! And, bonus, you can earn a little interest on that money while you’re at it!

Now you know exactly what a sinking fund is, and you have an idea of which categories in your budget need one. Set up your savings account(s) and get your sinking fund list started so you can keep up with the details of the auto-transfers you begin this month! Enjoy the peace you will have when that next large bill comes due, or when it’s time for that big purchase — especially around Christmas-time!

Can’t wait to hear which sinking funds you’re setting up!

As always, steward your money — and your life — intentionally.

Heather

/>

/> />

/>

I started saving up from Christmas in January this year (first time I’ve ever done that). I had no idea this concept was called sinking funds! Great tip about utilities and treating them like a sinking fund rather than a monthly expense.